Chargebacks are a costly reality for businesses in the adult industry. From fraud disputes to buyer’s remorse, these payment reversals not only eat into profits but can also damage a business’s reputation and lead to account suspensions with payment processors. Minimizing chargebacks isn’t just about reducing losses – it’s about safeguarding your revenue, maintaining strong banking relationships, and ensuring long-term sustainability.

By implementing proactive strategies, such as clear billing descriptors, robust fraud prevention tools, and transparent refund policies, adult businesses can significantly lower chargeback rates. This guide delves into the most effective ways to mitigate chargebacks, helping you create a secure, compliant, and customer-friendly payment ecosystem.

Understanding Chargebacks

A chargeback occurs when a customer disputes a transaction with their bank, leading to the reversal of the payment. Initially introduced in the 1970s through the Fair Credit Billing Act, chargebacks were designed to protect consumers from fraudulent or incorrect charges. While they serve an essential role in consumer protection, businesses often bear the brunt of financial losses associated with chargeback disputes.

Types of Chargebacks

Chargebacks generally fall into 3 categories:

- True Fraud Chargebacks: These occur when a stolen card is used fraudulently.

- Friendly Fraud Chargebacks: A customer disputes a legitimate charge, sometimes intentionally to avoid paying.

- Merchant Error Chargebacks: Mistakes made by the business lead to customer dissatisfaction and disputes.

Why the Adult Industry Faces a Higher Chargeback Risk?

While chargebacks are a concern for all businesses, the adult industry often faces a disproportionately higher risk. This is due to a combination of factors:

- Reputational Issues and “Buyer’s Remorse”: The social stigma associated with adult products and services can lead to feelings of guilt or embarrassment, prompting customers to file chargebacks even if the purchase was legitimate. They may want to hide the purchase from family members. This is a form of “friendly fraud”.

- Payment Processing Challenges: The adult industry is often classified as “high-risk” by payment processors, making it difficult to secure reliable and affordable payment processing. This can result in stricter underwriting, higher fees, and rolling reserves (a percentage of sales held by the processor to cover potential chargebacks).

- Customer Behavior: The impulsive nature of adult content can lead to purchases that customers later regret.

- Privacy Concerns: Customers may be more likely to dispute charges to maintain their privacy.

- Lack of Clear Communication & Transparency: Unclear subscription terms or billing practices can also contribute to chargebacks.

While hard numbers are difficult to come by, the adult industry generally experiences higher chargeback rates compared to other sectors.

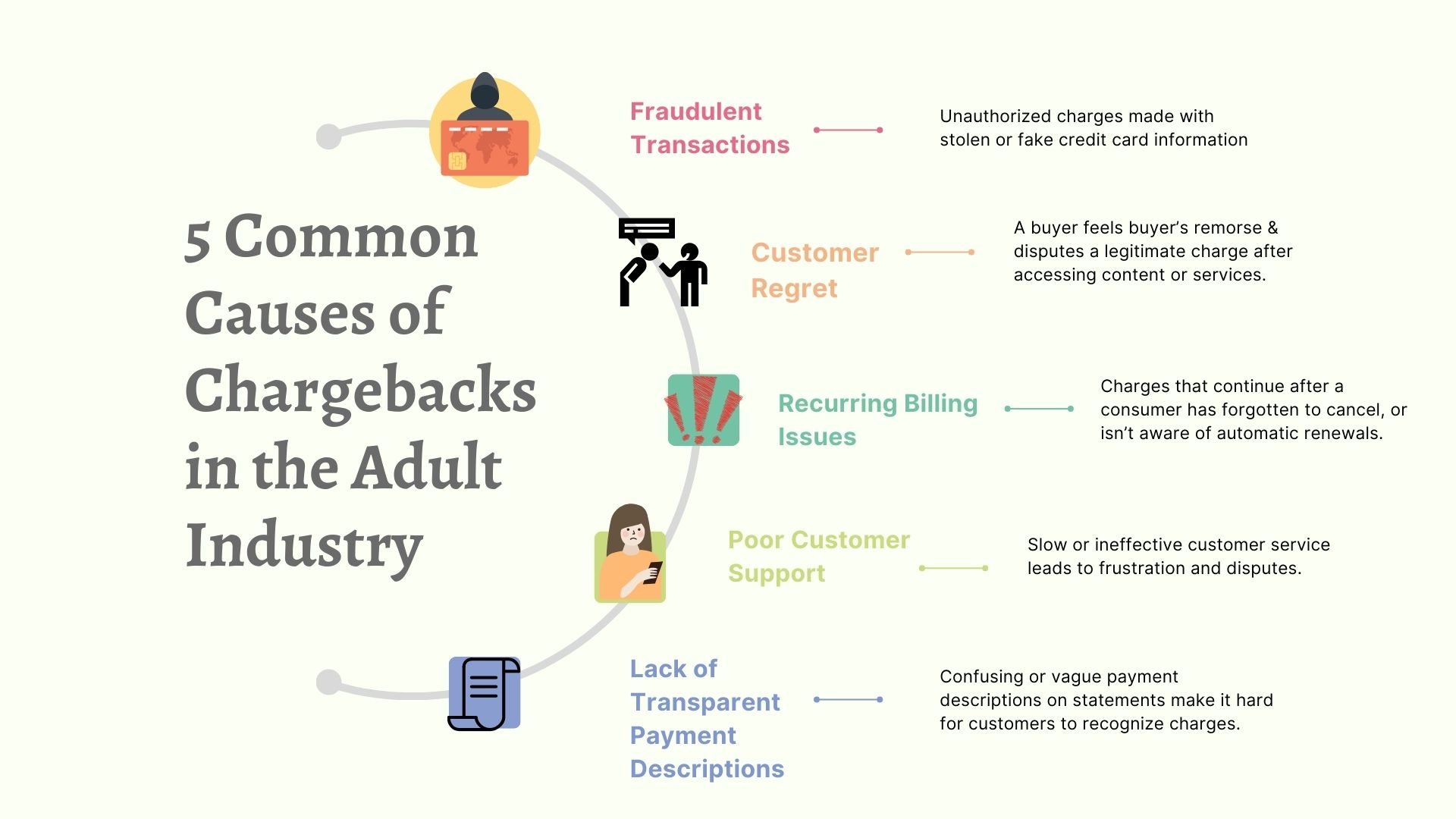

Common Causes of Chargebacks in the Adult Industry

Let’s break down some of the most common reasons why adult businesses get hit with chargebacks:

1. Fraudulent Transactions – Stolen Credit Cards Being Used for Purchases

One of the leading causes of chargebacks in the adult industry is credit card fraud. Cybercriminals often test stolen card details on adult sites, as they know many platforms offer instant digital access with minimal verification. This leads to a surge in unauthorized transactions that eventually get disputed by the actual cardholder.

🔹 Example: A fraudster purchases a premium subscription to an adult site using stolen credit card details. When the real cardholder checks their statement and notices an unfamiliar charge, they immediately file a chargeback.

How This Hurts Businesses:

- The merchant loses both the revenue and the content or service that was provided.

- Payment processors may impose penalties or even terminate accounts due to excessive fraud-related chargebacks.

2. Customer Regret – Impulse Purchases Leading to Disputes

Impulse buying is common in the adult industry, as customers often make quick purchasing decisions based on desire rather than necessity. However, after the excitement wears off, some may feel guilty or regret the purchase, leading them to dispute the charge instead of requesting a refund.

🔹 Example: A customer signs up for an exclusive adult content platform late at night but wakes up the next morning feeling embarrassed. Instead of contacting customer support, they file a chargeback, claiming they never authorized the transaction.

How This Hurts Businesses:

- High chargeback rates lead to increased scrutiny from banks and payment processors.

- Legitimate businesses lose revenue due to customer dishonesty.

3. Recurring Billing Issues – Forgotten Subscriptions or Unclear Cancellation Policies

Many adult platforms operate on a subscription model, which can lead to chargebacks when customers forget about ongoing charges or don’t fully understand the cancellation process. Some users also take advantage of “trial abuse”, where they sign up for a low-cost trial and later claim they never authorized the renewal.

🔹 Example: A customer signs up for a $1 trial to an adult streaming site, but they don’t realize it auto-renews at $29.99 per month. When they see the charge on their statement, they dispute it rather than canceling their subscription.

How This Hurts Businesses:

- Subscription-based businesses experience high levels of chargebacks, increasing their risk profile with payment processors.

- Customers who don’t read terms & conditions may file chargebacks even if the charges are valid.

4. Poor Customer Support – Customers Filing Chargebacks Instead of Contacting Support

A lack of accessible and responsive customer service is a major contributor to chargebacks. If customers struggle to get in touch with a business for refunds, cancellations, or billing disputes, they are more likely to go directly to their bank to dispute the charge.

🔹 Example: A user has trouble logging into their paid adult site subscription and can’t find a contact email or phone number. Frustrated, they file a chargeback instead of waiting for assistance.

How This Hurts Businesses:

- Avoidable chargebacks increase the company’s dispute ratio, leading to potential penalties from payment processors.

- Poor customer service damages brand reputation and reduces customer retention.

5. Lack of Transparent Payment Descriptions – Vague or Suspicious Charges on Statements

If a customer sees an unfamiliar or unclear charge on their bank statement, they may assume it’s fraudulent, even if it’s a legitimate purchase. Many adult businesses use discreet billing descriptors to protect customer privacy, but sometimes, this leads to confusion if the descriptor is too vague.

🔹 Example: A user subscribes to an adult site, but instead of seeing a charge from “PremiumAdultContent.com” on their statement, they see “XYZ Services Ltd.” They don’t recognize the name and immediately dispute the charge.

How This Hurts Businesses:

- Chargebacks from unrecognized transactions are common in industries that use discreet billing.

- Confusing payment descriptions lead to higher refund rates and unnecessary disputes.

Strategies to Minimize Chargebacks in the Adult Industry

Chargebacks can significantly impact the bottom line for adult businesses. The good news is that a proactive approach, utilizing several key strategies, can substantially reduce your chargeback rate and protect your revenue.

Let’s explore some effective methods:

1. Implement Fraud Prevention Measures

Fraudulent transactions, including stolen credit card usage, are a major cause of chargebacks in the adult industry. Since digital content and services can be accessed instantly, fraudsters often exploit adult sites to test stolen card details.

🔹 Why It Matters: Fraudulent chargebacks lead to high dispute ratios, which can result in increased processing fees or even merchant account shutdowns.

How to Prevent Fraud:

✅ Enable 3D Secure (3DS2) – Adds an extra layer of authentication for transactions.

✅ Use Address Verification System (AVS) – Matches billing addresses to cardholder details to detect mismatches.

✅ Require CVV Verification – Ensures customers have physical access to the card.

✅ Deploy AI-Based Fraud Detection Tools – Detects suspicious activity based on transaction behavior.

✅ Blacklist Known Fraudulent Users – Maintain an internal list of high-risk IP addresses and chargeback abusers.

2. Offer Clear and Transparent Billing Descriptions

Many chargebacks occur simply because customers don’t recognize a charge on their bank statement. While discreet billing helps protect user privacy, vague descriptors can lead to confusion.

🔹 Why It Matters: Customers who don’t recognize a transaction are more likely to dispute it, even if it was legitimate.

Best Practices for Billing Transparency:

✅ Use a recognizable but discreet descriptor (e.g., “XYZAdult-Subscription” instead of “XYZ Services Ltd.”).

✅ Send immediate email confirmations with billing details after a purchase.

✅ Include a customer support contact on invoices so users can resolve issues before filing chargebacks.

✅ Provide a self-service billing portal where customers can check past transactions.

Example: Instead of “ABC Processing LLC,” a dating site updates its billing descriptor to “ABC Dating Premium” to ensure customers recognize the charge.

3. Improve Customer Support and Communication

Poor customer service is a direct contributor to chargebacks. If customers can’t reach support to resolve issues, they’ll turn to their bank instead.

🔹 Why It Matters: Customers who feel unheard or frustrated are more likely to initiate disputes, even for valid charges.

How to Improve Customer Support:

✅ Offer 24/7 live chat or phone support to handle billing concerns quickly.

✅ Respond to emails within 24 hours to prevent escalations.

✅ Provide a dedicated refund or dispute resolution process to handle complaints internally.

✅ Include a FAQ section addressing common concerns about billing and cancellations.

Example: An adult content platform implements live chat support, reducing chargebacks by 20% as customers now reach out for assistance instead of disputing transactions.

4. Optimize Subscription and Cancellation Policies

Recurring billing disputes are one of the most common sources of chargebacks in the adult industry. Many users forget they signed up for an adult subscription or don’t understand the cancellation process.

🔹 Why It Matters: Confusing or hidden cancellation policies frustrate customers, increasing the likelihood of chargebacks.

Best Practices for Subscription Management:

✅ Send subscription reminders before automatic renewals.

✅ Make cancellation policies clear and easy to follow (no hidden terms).

✅ Allow users to pause or cancel subscriptions online without needing to contact support.

✅ Offer pro-rated refunds for partial subscription periods to retain goodwill.

Example: A streaming site sends a renewal reminder three days before charging a customer, reducing chargeback disputes from “I didn’t know I was being billed.”

5. Maintain Detailed Transaction Records

Keeping accurate and detailed transaction records is crucial for fighting chargebacks and proving the legitimacy of a sale.

🔹 Why It Matters: If a chargeback occurs, having solid evidence increases the chances of successfully reversing it.

How to Maintain Strong Transaction Records:

✅ Store IP logs, timestamps, and purchase history to verify transactions.

✅ Keep copies of email confirmations and receipts for every purchase.

✅ Document customer interactions (e.g., cancellation requests, refunds, complaints).

✅ Capture user agreements and terms of service acceptance during checkout.

Example: A chargeback is filed claiming “unauthorized transaction,” but the merchant successfully disputes it by providing login timestamps, purchase confirmations, and an IP address matching the customer’s location.

6. Use Chargeback Alerts and Representment Services

Chargeback alerts and representment services help merchants detect and respond to disputes before they escalate.

🔹 Why It Matters: Chargeback management services give businesses a chance to resolve disputes before losing revenue or damaging their chargeback ratio.

Key Solutions to Consider:

✅ Chargeback Alerts (Verifi, Ethoca) – Notifies merchants of pending disputes, allowing them to refund customers before the chargeback is finalized.

✅ Chargeback Representment Services – Helps merchants fight unjust chargebacks by compiling evidence and submitting formal responses.

✅ Payment Processors with Chargeback Protection – Some high-risk processors offer built-in chargeback prevention tools.

Example: A premium adult dating site integrates with Ethoca’s chargeback alert system, reducing disputes by 35% as they proactively issue refunds before disputes become chargebacks.

Best Payment Processors for Adult Businesses

Finding a reliable payment processor is one of the biggest challenges for adult businesses. Due to the industry’s high-risk nature, mainstream payment providers like PayPal, Stripe, and Square often ban or restrict adult merchants, leaving them searching for alternatives.

Whether you run an adult content platform, webcam site, dating service, or online store selling adult products, choosing the right payment processor is crucial for seamless transactions, lower chargeback risks, and business stability.

Here’s a list of the best payment processors for adult businesses:

🔹 CCBill – A trusted provider for over 20 years, CCBill is ideal for subscription-based adult websites, offering recurring billing, fraud protection, and multi-currency support.

🔹 Segpay – Best for membership and token-based platforms, Segpay provides chargeback management, 18+ verification, and strong fraud prevention tools.

🔹 Epoch – Known for its global reach, Epoch supports multi-currency processing, flexible payment options, and pay-per-view transactions, making it great for international adult platforms.

🔹 NETbilling – A customizable payment solution with direct merchant accounts, NETbilling is perfect for adult e-commerce stores and high-risk transactions.

🔹 Paxum – A popular payout solution for content creators, cam models, and affiliates, Paxum enables fast transfers and low transaction fees.

Each of these processors provides secure, industry-compliant solutions tailored to adult businesses, ensuring smooth payments and minimal risk of account freezes. Choosing the right one depends on your business model, fees, and fraud prevention needs. 🚀

Final Thoughts

Minimizing chargebacks in the adult industry requires a proactive approach that balances fraud prevention, clear billing practices, and top-tier customer support. By implementing strong security measures, offering transparent payment descriptions, and streamlining subscription policies, businesses can reduce disputes and maintain a healthy merchant account. Additionally, leveraging chargeback alerts and representment services helps safeguard revenue while building trust with customers. The key is prevention over reaction, staying ahead of issues ensures smoother transactions, fewer disputes, and a more profitable, sustainable business. Prioritize these strategies, and you’ll keep your operations secure, compliant, and customer-friendly.

Hi

Start Growing Your Dream Business

with Us!

Nathan

Head of Technical Support at Adent.io

Nathan leads Adent.io’s Technical Support team with a commitment to excellence, ensuring clients receive the help they need to succeed with their adult website platforms. A graduate of Chulalongkorn University with years of experience in technical support, Nathan combines his education with a deep understanding of Adent.io’s ready-made adult scripts, providing responsive, reliable assistance tailored to each client’s needs.