The SexTech industry is no longer a whispered topic; it’s a booming sector driving innovation, breaking taboos, and reshaping how we think about intimacy and technology. From AI-powered devices to virtual reality experiences, the fusion of tech and sexual wellness is a multi-billion-dollar revolution.

As societal attitudes shift and investments surge, the numbers reveal a staggering growth trajectory, proving this industry is anything but niche. In this deep dive, we’ll uncover the latest statistics, emerging trends, and future possibilities that make SexTech business one of the most exciting frontiers for entrepreneurs, innovators, and forward-thinkers alike. Let’s explore the numbers behind the passion!

Global SexTech Market Overview

This overview provides key insights into the current market size, projected growth, and the main drivers and challenges facing this dynamic sector.

Current Market Size and Growth Rate (2023-2024)

As of 2023, the global SexTech market is valued at approximately $37 billion, with an impressive annual growth rate of around 15%. This growth is fueled by:

- Increasing consumer openness towards sexual wellness products

- Technological advancements such as AI, VR, and IoT-enabled devices

- Rise of direct-to-consumer (D2C) channels

- A growing acknowledgment of sexual wellness as a crucial component of overall health.

Notably, the VR porn subscription site segment has been a standout performer, with companies like VR Bangers reporting a 30% sales increase during COVID-related lockdowns.

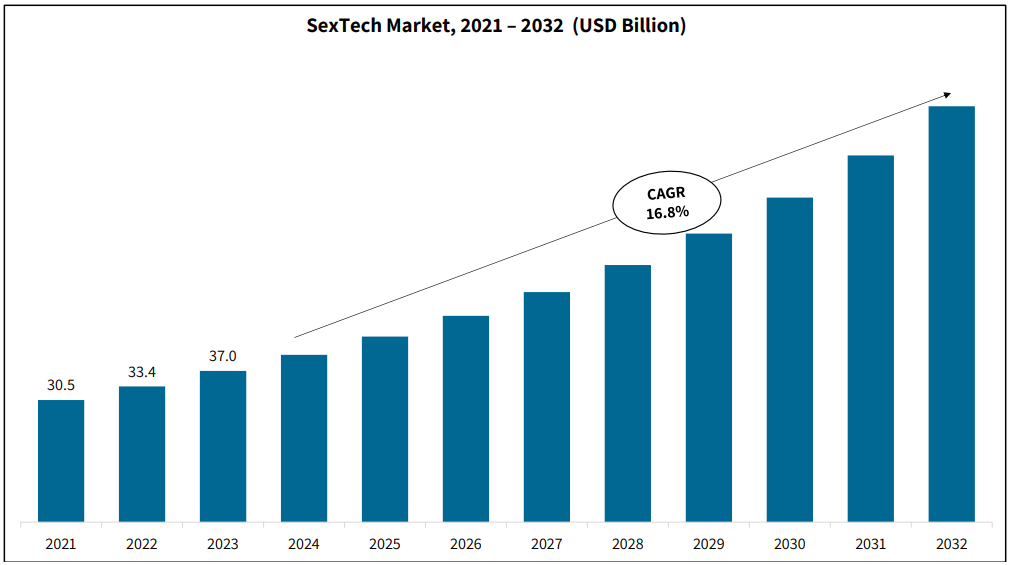

Projected Market Growth and Forecast (2024-2032)

Looking ahead, the SexTech market is projected to reach $144.7 billion by 2032, with a compound annual growth rate (CAGR) of 16.8% from 2024 to 2032.

Expect rapid expansion in B2C channels, particularly online platforms, which already account for 70% of sales. The demand for personalized and discreet experiences will likely dominate market strategies in the coming years.

Key Market Challenges

Here’s a closer look at the key challenges:

- Regulatory Hurdles – Different regulations across regions can complicate market entry for new products, impacting innovation.

- Cultural Taboos – Varying degrees of acceptance across regions can slow adoption.

- Privacy Concerns – As technology becomes more integrated into personal lives, concerns over data privacy and security are increasingly paramount.

The SexTech industry stands at a pivotal moment, characterized by significant growth opportunities tempered by unique challenges. As technology continues to evolve and societal norms shift, this market is poised for further expansion in the coming years.

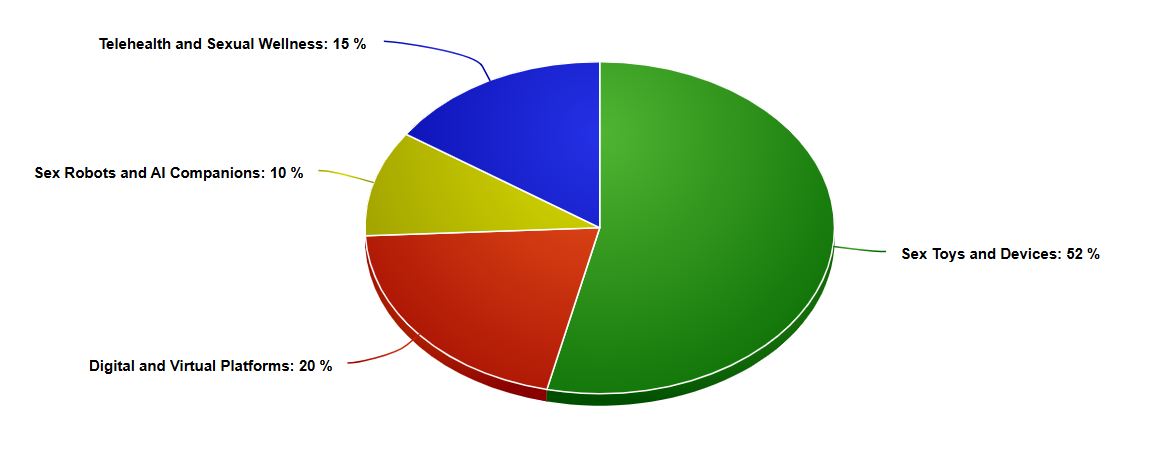

SexTech Product Segmentation

Sextech product segmentation provides a clearer understanding of the different categories within the market, highlighting innovations and trends that are shaping consumer choices.

| SexTech Segment | Market Share (Approx.) | Leading Companies/Platforms | Key Features |

| Sex Toys and Devices | 50% | Lovense, We-Vibe, LELO, MysteryVibe | Bluetooth-enabled toys, app-controlled interfaces, AI-powered customization for enhanced intimacy. |

| Digital and Virtual Platforms | 20% | Dipsea, Coral, BaDoinkVR, VR Bangers | VR porn for immersive experiences, sexual wellness apps for education and exploration. |

| Sex Robots and AI Companions | 10% | RealDoll X, AI Chatbots (Replika), DS Doll Robotics | Lifelike robots with customizable features, AI-driven emotional companionship. |

| Telehealth and Sexual Wellness | 15% | Ro, Hims, Clue, Pandia Health | Digital consultations, reproductive health tracking, discreet and accessible sexual health services. |

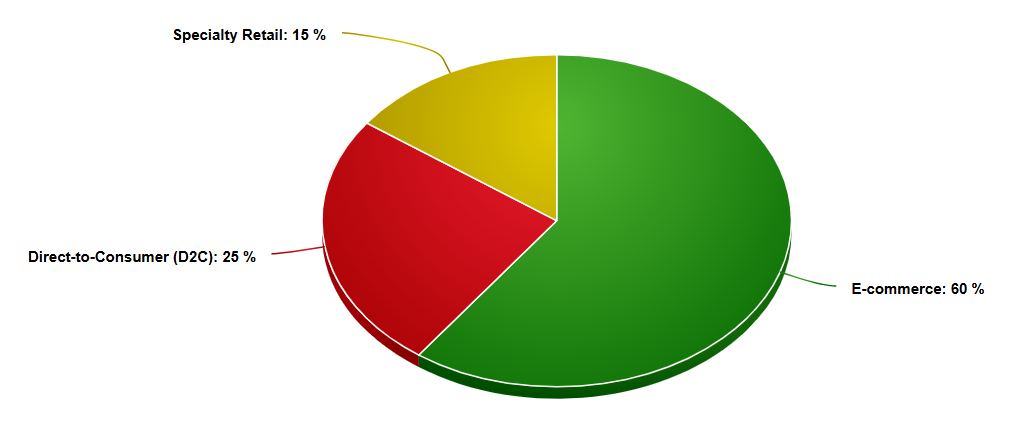

| Distribution Channels | E-commerce: 60% | Amazon, Lovehoney, Adam & Eve | Convenience and privacy in online purchasing with discreet delivery options |

| D2C: 25% | LELO, OhMiBod | Direct access to products through branded websites, often with tailored recommendations and exclusive offers. | |

| Specialty Retail: 15% | Pleasure Chest, Babeland | In-person consultations, allowing consumers to explore products physically. |

By focusing on these segmented insights, businesses can identify the areas of highest growth potential while addressing challenges in innovation, inclusivity, and accessibility.

Regional Market Analysis

The global SexTech industry is witnessing diverse growth patterns across regions, with varying market sizes, trends, and emerging opportunities. Below is a detailed analysis with region-specific insights.

North America

- Market Size (2023) – $20 billion, projected to grow at a CAGR of 12% by 2031.

- Trends – High adoption of advanced sexual wellness products, growing investments in AI and VR technologies, and increased awareness of sexual health.

- Leading Countries – The US dominates (85% of the regional market), with Canada following. The U.S. leads in VR content and smart toys sales.

Key Insight – North America remains the largest market, driven by technological advancements and consumer acceptance of SexTech.

Europe

- Market Size (2023) – $15 billion, growing at a CAGR of 10% from 2024 to 2031.

- Major Markets – Germany, the UK, and France contribute significantly, accounting for 70% of the market.

- Trends – Increased focus on sexual wellness education, rise in telehealth services, and demand for eco-friendly sex toys.

Key Insight – Europe emphasizes sustainability and inclusivity, making it a leading hub for innovation in sexual wellness products.

Asia-Pacific

- Market Size (2023) – $12 billion, with a rapid growth forecast of CAGR 15% until 2031.

- Key Markets – China, Japan, and India dominate due to increasing disposable incomes and changing cultural attitudes.

- Trends – Expansion of e-commerce platforms like Tmall (China) and Rakuten (Japan), coupled with growing interest in sexual health apps and VR content.

Key Insight – Asia-Pacific is the fastest-growing region, with rising awareness and accessibility driving market expansion.

Latin America and MEA (Middle East & Africa)

- Market Size (2023) – $8 billion, with a CAGR of 13% through 2031.

- Emerging Markets – Brazil, South Africa, and UAE are leading contributors.

- Trends – Increasing urbanization, growing acceptance of sexual wellness products, and penetration of global brands into local markets.

Key Insight – These regions offer untapped potential, with a focus on affordable and culturally adaptive products.

Key Players in the SexTech Market

The SexTech market is rapidly growing, driven by rising awareness of sexual wellness, technological innovation, and inclusivity. Major players include:

- Lovense (Singapore) – Known for Bluetooth-enabled sex toys like the Solace Automatic Stroker, offering cutting-edge features for personalized experiences.

- Lelo (Sweden) – Specializes in luxury toys such as app-connected devices like the Hugo 2 prostate massager.

- OhMiBod (US) – OhMiBod pioneers in integrating music and intimacy with app-controlled vibrators.

- MysteryVibe (UK) – Offers highly customizable and ergonomic toys, such as their flagship product, the Crescendo.

- We-Vibe (Canada) – We-Vibe focuses on couples’ intimacy with remote-controlled devices.

- RealDoll – A pioneer in the sex robot segment, RealDoll combines advanced robotics with lifelike features to create companions that cater to a range of consumer preferences.

- Shenzhen Atall Intelligent Robot Technology – A significant player in the Asia-Pacific region, this company manufactures high-quality sex robots, capitalizing on the growing demand in markets like China and Japan.

Startups like Blueheart and KAMA are introducing platforms for sexual wellness, emphasizing inclusivity and emotional health alongside physical pleasure.

Pro Tip: Fascinated by the world of sex dolls? Get your hands on Sex Doll Statistics for eye-opening insights and trends you won’t want to miss!

Notable Mergers, Acquisitions, and Partnerships

In recent years, the SexTech industry has witnessed remarkable consolidation and collaborations, signaling rapid growth and innovation.

1. WOW Tech Group and Lovehoney Merger

- Year – 2021

- Details – WOW Tech Group and Lovehoney united in a EUR 1.2 billion merger to form the Lovehoney Group, combining industry-leading brands like We-Vibe and Womanizer.

- Impact – This merger enhances international outreach and focuses on product innovation, strengthening their position in the global sexual wellness market.

2. Dame Acquires Emojibator

- Year – 2024

- Details – Dame Products acquired Emojibator, a brand known for its playful, emoji-themed vibrators.

- Impact – This acquisition reflects a growing trend of consolidation in the sexual wellness sector, allowing Dame to expand its market presence and diversify its offerings.

3. Kiiroo Partners with Hot Octopuss

- Year – 2021

- Details – Interactive sex toy pioneer Kiiroo partnered with Hot Octopuss to co-develop cutting-edge products that integrate interactivity with pleasure.

- Impact – This collaboration pushes technological boundaries, delivering enhanced user experiences that marry innovation with intimacy.

4. Yellow Wood Partners Launches Beacon Wellness Brands

- Year – 2022

- Details – Private equity firm Yellow Wood Partners created Beacon Wellness Brands by acquiring multiple product lines from Clio, including PlusOne.

- Impact – Beacon aims to democratize access to sexual wellness products by distributing them across mass retail channels, meeting the demand for affordability and accessibility.

5. Ethical Capital Partners Acquires MindGeek LLC

- Year – 2023

- Details – Ethical Capital Partners acquired MindGeek, the parent company of Pornhub, with a focus on promoting responsible adult entertainment and fostering awareness around consent and ethics in adult content.

- Impact – This acquisition underscores the importance of ethical considerations in the adult entertainment industry, setting a precedent for transparency and social responsibility.

6. Lovense and ChatGPT Collaboration

- Year – 2023

- Details – Lovense introduced its ChatGPT Pleasure Companion app, allowing users to create personalized, AI-driven stories that sync with their devices.

- Impact – This innovative partnership combines AI and SexTech, offering highly customizable and interactive user experiences, marking a new frontier in digital intimacy.

These strategic moves highlight the dynamic evolution of the SexTech market, fostering innovation, inclusivity, and ethical awareness while setting the stage for a more connected and accessible future.

Future Trends and Market Opportunities

The SexTech industry is on the brink of significant transformation. As the market continues to grow, several key trends and opportunities are emerging that will shape the future of this sector.

This analysis focuses on 3 primary areas: inclusivity and diversity in products, the growth of remote intimacy solutions, and forecasts for various market segments.

1. Increased Focus on Inclusivity and Diversity in Products

The modern consumer demands inclusivity, with brands increasingly tailoring products for diverse gender identities, sexual orientations, and physical abilities.

For example:

- Gender-Neutral Devices – Companies like Tenga are introducing toys that cater to a broader audience without gender-specific designations.

- Products for Differently-Abled Users – Innovations in ergonomic designs and customizable settings, such as MysteryVibe’s Crescendo, provide accessibility without compromising functionality.

This trend aligns with a broader societal shift towards representation and equality, creating opportunities for companies to tap into previously underserved markets.

2. Growth of Remote Intimacy and Long-Distance Solutions

The global pandemic accelerated the demand for technologies that facilitate intimacy over distance. Key developments include:

- App-Connected Devices – Companies like Lovense and We-Vibe lead in this segment, offering toys controlled via mobile apps for synchronized, long-distance interactions.

- VR Integration – VR porn platforms are integrating with haptic feedback devices to deliver immersive and shared experiences.

With more couples navigating long-distance relationships, this segment is poised for significant growth. Analysts project the remote intimacy segment could achieve a CAGR exceeding 15% through 2030.

3. Forecasts for Market Segments

- Sex Robots – Innovations in AI and robotics are driving demand for hyper-realistic sex robots. Companies like RealDoll are incorporating machine learning to enhance personalization, a segment forecasted to grow by 22% CAGR through 2031.

- VR Innovations – The adoption of virtual reality in SexTech is revolutionizing content creation and user engagement. VR applications in adult entertainment and therapy are expected to surpass $1 billion by 2030.

- HealthTech Integrations – The convergence of sexual wellness and health technology, such as telehealth platforms and sexual therapy apps, offers a promising growth avenue. Digital consultations for sexual health, led by platforms like Blueheart, are gaining traction.

Final Words

The SexTech industry is no longer a niche market but a global phenomenon, transforming how intimacy, wellness, and technology intersect. With innovative advancements, growing market segments, and shifting consumer attitudes, this sector offers immense opportunities for entrepreneurs, investors, and innovators alike.The future of SexTech lies in fostering inclusivity, harnessing technological breakthroughs, and addressing societal concerns responsibly. As the market continues to evolve, it promises to redefine personal connections and expand the horizons of human intimacy like never before.

Hi

Start Growing Your Dream Business

with Us!

Charles

Chief Marketing Officer at Adent.io

Charles is the Chief Marketing Officer at Adent.io, where he directs marketing strategies that drive the company’s growth and innovation. Alongside his primary role, Charles also provides expert advice and tailored strategies to Adent.io’s clients, empowering them to thrive in the competitive adult industry.

and Welcome to Adent.io

and Welcome to Adent.io